Citicore Renewable Energy Corporation has secured a Php 3.975 billion (approximately US$68 million) loan from the Bank of the Philippine Islands (BPI) to finance the construction of its newest solar energy facility in Pangasinan, the 113-megawatt Citicore Solar Pangasinan 2. The project is a key component of the country’s accelerating transition toward renewable power and underscores growing confidence in the viability of clean energy infrastructure in the Philippines.

Major Solar Park to Power Thousands of Homes

Located in Binalonan, Pangasinan, the solar photovoltaic (PV) project represents the second phase of Citicore’s renewable energy development in the region, following the earlier completion of a 125 MW facility in Sta. Barbara. Combined, the two phases will contribute over 240 MW of clean energy to Luzon’s power grid, with the capacity to generate hundreds of gigawatt-hours annually — enough to power more than 136,000 households.

The second phase, now funded for completion, received a Certificate of Energy Project of National Significance from the Department of Energy, granting the development expedited permitting and regulatory processing to ensure a timely rollout. This certification is part of the government’s broader push to streamline priority projects aligned with national energy goals.

Long-Term Revenue Security Under Green Energy Program

Both phases of the solar development are backed by 20-year power offtake agreements under the Green Energy Auction Program (GEAP-2), launched by the Department of Energy to incentivize and stabilize private investment in renewables. These contracts ensure long-term revenue for the projects by guaranteeing that electricity produced will be purchased by the government at pre-agreed rates.

This mechanism not only mitigates market risk for renewable developers like Citicore but also provides grid planners with predictable energy inputs — a crucial factor as the country grapples with capacity shortfalls and fluctuating supply in a coal-dependent power matrix.

BPI Backs Solar Growth With Strategic Green Financing

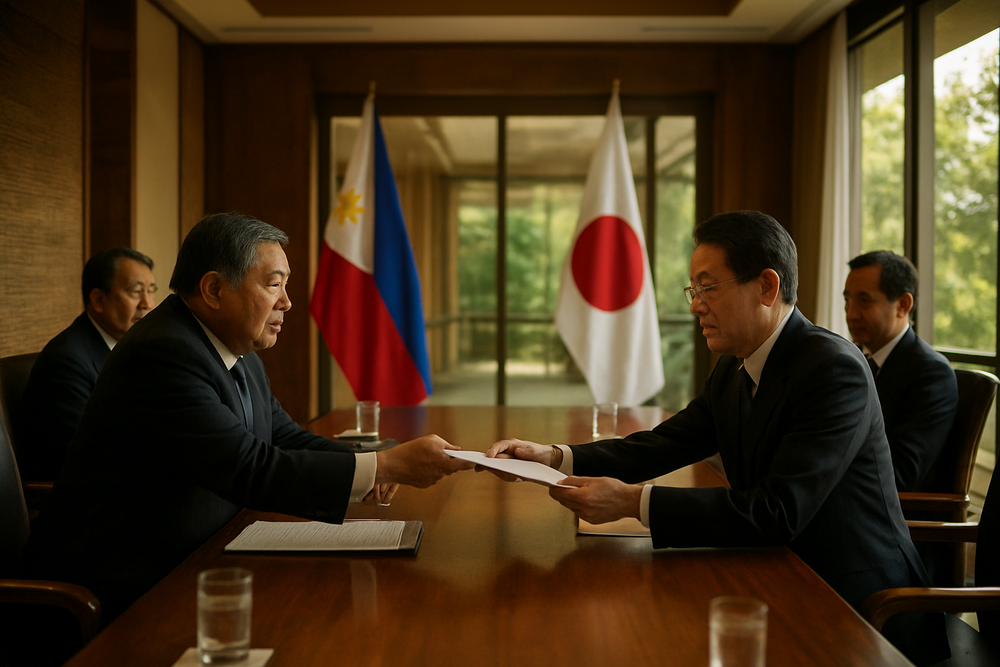

The loan facility was signed on December 3, 2025, with project completion expected before the end of 2025. BPI Capital Corporation served as the sole lead arranger for the debt facility, a move that highlights the strength of Citicore’s financial planning and BPI’s growing role in sustainable finance initiatives.

“With BPI partnering with us through this project finance agreement, we strengthen our ability to deliver on our commitments and continue championing renewable energy in the country,” said Oliver Y. Tan, President and CEO of Citicore Renewable Energy Corporation.

Louie Cruz, Head of Institutional Banking at BPI, stressed the lender’s strategic commitment to climate-focused investments: “This partnership reflects our commitment to financing projects that drive sustainable progress by enabling investments that not only deliver clean energy solutions but also create lasting positive impact for the communities.”

Lester Ong, President of BPI Capital, emphasized that the bank’s exclusive participation as loan arranger signals a strong alignment with national energy targets and trust in Citicore’s vision. The company aims to install 5 gigawatts of renewable capacity in five years.

Renewable Energy as Catalyst for Local Development

The 113 MW project is part of Citicore’s broader investment strategy in Pangasinan, which also includes a planned wind energy facility in early stages of development. Together, these ventures are expected to not only buttress national power supply, but to also generate thousands of jobs and spur economic activity in the region.

Pangasinan Governor Ramon V. Guico III, who joined Citicore executives at the project’s groundbreaking ceremony on March 20, 2024, has consistently voiced support for green investments in his province, pointing to the dual benefits of energy sustainability and job creation for local communities.

Clean Energy Momentum Gains Ground Nationally

The Citicore development is emblematic of a broader commitment by the Philippine government to pivot toward more sustainable energy sources. The Department of Energy aims to increase the share of renewables in the energy mix from just over 20% to at least 35% by 2030, and 50% by 2040 — an ambition supported by policy instruments such as the Green Energy Auction Program.

Financial institutions have responded to this momentum. In August 2023, BPI secured a US$250 million green bond investment from the International Finance Corporation to bolster its climate-linked lending portfolio. This includes support for multiple renewable projects across the country, such as a 221 MW solar plant in Olongapo.

Looking Ahead

The construction of the Citicore Solar Pangasinan 2 project is not simply the expansion of an energy portfolio — it is a strategic step forward in the Philippines’ unfolding energy transition. With solid financial backing, long-term regulatory stability, and local community alignment, the solar park stands poised to become a cornerstone of Luzon’s clean power supply before the end of 2025.

For a country confronting the twin challenges of climate vulnerability and rising energy demand, the successful execution of projects like this reflects a growing capacity to chart a sustainable path forward — one sunbeam at a time.